Starting a business in London is an exciting venture, but it comes with its own set of challenges, particularly in managing finances and ensuring sustainable growth.

One of the most effective ways to keep your startup on the right track is by monitoring key performance indicators (KPIs).

These metrics provide valuable insights into your financial health and help you make informed decisions.

Explore the essential financial KPIs every London startup should track, how to measure them, and why they are crucial for your business success.

1. Gross Profit Margin

Gross profit margin is a fundamental KPI that measures the percentage of revenue that exceeds the cost of goods sold (COGS). It indicates how efficiently your business is producing and selling its products or services.

Formula:

Why It Matters:

- Profitability Indicator: It shows how much money is left over to cover operating expenses after paying for the cost of production.

- Cost Control: Helps identify if production costs are too high relative to sales.

Example:

If your startup generates £100,000 in revenue and has £60,000 in COGS, the gross profit margin would be 40%. This means you retain 40p from every pound of revenue after covering production costs.

Actionable Step:

Regularly review your gross profit margin to ensure it stays within a healthy range. Adjust pricing strategies or reduce production costs if the margin is declining.

2. Burn Rate

Burn rate is a crucial KPI for startups, particularly those in the early stages of growth. It measures the rate at which a company is spending its capital to cover expenses before generating positive cash flow.

Formula:

Burn Rate=Monthly Operating Expenses

Why It Matters:

- Cash Flow Management: Indicates how long your business can operate before needing additional funding.

- Investment Readiness: Investors look at burn rate to assess the financial health and sustainability of a startup.

Example:

If your startup has monthly operating expenses of £20,000 and £100,000 in the bank, your burn rate is £20,000 per month. This means you have five months of runway before needing additional funds.

Actionable Step:

Monitor your burn rate closely and take action to extend your runway by reducing expenses or securing additional funding. Tools like financial forecasting software can help you project future cash needs.

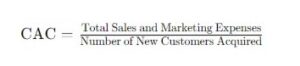

3. Customer Acquisition Cost (CAC)

Customer Acquisition Cost (CAC) measures the cost associated with acquiring a new customer. This KPI is critical for evaluating the efficiency of your marketing and sales efforts.

Formula:

Why It Matters:

- Budget Allocation: Helps determine the effectiveness of your marketing spend.

- Pricing Strategy: Influences pricing strategies and overall profitability.

Example:

If your startup spends £10,000 on marketing in a month and acquires 50 new customers, the CAC is £200. This means it costs £200 to acquire each new customer.

Actionable Step:

Evaluate and optimise your marketing strategies to lower CAC. Consider leveraging digital marketing channels, improving customer targeting, or refining your sales funnel.

4. Lifetime Value of a Customer (LTV)

Lifetime Value (LTV) estimates the total revenue a business can expect from a single customer account throughout their relationship with the company.

Formula:

LTV=Average Purchase Value×Purchase Frequency×Customer Lifespan

Why It Matters:

- Customer Retention: Highlights the importance of retaining customers for longer periods.

- Strategic Decisions: Informs decisions on marketing spend, customer service investments, and product development.

Example:

If a customer typically spends £50 per purchase, makes purchases twice a month, and remains a customer for two years, the LTV is £2,400.

Actionable Step:

Focus on increasing LTV by improving customer satisfaction, offering loyalty programs, and upselling or cross-selling products.

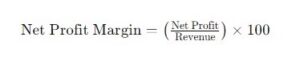

5. Net Profit Margin

Net profit margin is the percentage of revenue remaining after all expenses, taxes, and costs have been deducted from total revenue. It provides a comprehensive view of your business’s overall profitability.

Formula:

Why It Matters:

- Overall Health: Indicates the overall financial health and efficiency of the business.

- Investor Confidence: A higher net profit margin can attract investors and secure funding.

Example:

If your startup has a net profit of £30,000 and total revenue of £150,000, the net profit margin is 20%. This means you retain 20p of every pound earned as profit.

Actionable Step:

Improve your net profit margin by increasing revenue, reducing costs, or finding efficiencies in your operations.

6. Cash Flow Forecast

A cash flow forecast estimates the amount of cash expected to flow in and out of your business over a given period. It helps ensure that your business has enough cash to meet its obligations.

Why It Matters:

- Liquidity Management: Helps in maintaining sufficient cash reserves to cover operational expenses.

- Future Planning: Assists in making informed decisions about expansions, investments, and hiring.

Example: A cash flow forecast might show that your startup will face a shortfall in three months due to seasonal sales fluctuations, prompting you to arrange additional funding in advance.

Actionable Step:

Regularly update your cash flow forecast and use tools like Xero or QuickBooks for real-time insights. Address any potential shortfalls proactively.

7. Revenue Growth Rate

Revenue growth rate measures the increase in your company’s sales over a specific period. It’s a vital indicator of business expansion and market acceptance.

Formula:

Why It Matters:

- Growth Indicator: Shows how quickly your business is growing and whether your strategies are effective.

- Market Position: Helps in assessing your position relative to competitors.

Example:

If your revenue was £100,000 last year and £120,000 this year, the revenue growth rate is 20%.

Actionable Step:

Track revenue growth regularly and analyse the factors driving growth. Invest in marketing, product development, and customer acquisition to sustain growth.

Conclusion

Tracking these essential financial KPIs will provide your London startup with the insights needed to make informed decisions, optimise operations, and achieve sustainable growth.

Each KPI offers a unique perspective on your business’s financial health and performance, helping you comply with the complexities of the startup landscape.

At Adroit, we understand the challenges that London startups face and offer tailored services to help you track and optimise your financial KPIs.

Book your free consultation now to discover how we can support your business’s growth and financial management needs.

Book your free consultation now by clicking here.

For further reading on financial KPIs and management, explore the Harvard Business Review: KPIs and Metrics for Startups.

By closely monitoring and analysing these KPIs, your startup can not only survive but thrive in the competitive London market.

Let Adroit help you every step of the way.