In the fast-paced world of startups, monitoring financial performance is crucial to ensure sustainable growth and long-term success. Key Performance Indicators (KPIs) are vital tools for tracking and measuring the financial health of your business. By understanding and monitoring these financial KPIs, startups can make informed decisions, attract investors, and stay on the path to profitability. Here’s an in-depth guide on the essential financial KPIs for startups, written with British English spelling.

Understanding Financial KPIs

Financial KPIs are metrics used to evaluate the financial performance and health of a business. They provide insights into various aspects of a company’s financial status, including profitability, liquidity, and operational efficiency. For startups, tracking these KPIs is essential for managing growth, securing funding, and achieving business goals.

Key Financial KPIs for Startups

1. Revenue Growth Rate

What It Is: The percentage increase in a company’s revenue over a specific period.

Why It’s Important: Revenue growth is a fundamental indicator of business expansion and market acceptance. Consistent growth in revenue signifies that the startup is gaining traction and scaling effectively.

How to Calculate It:

2. Gross Profit Margin

What It Is: The percentage of revenue that exceeds the cost of goods sold (COGS).

Why It’s Important: Gross profit margin indicates the efficiency of production processes and the business’s ability to manage costs. A higher margin suggests better profitability.

How to Calculate It:

3. Burn Rate

What It Is: The rate at which a startup spends its capital to cover operating expenses before generating positive cash flow.

Why It’s Important: Understanding the burn rate helps startups manage cash flow and plan for future funding needs. It’s crucial for ensuring the company doesn’t run out of money.

How to Calculate It:

![]()

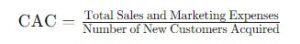

4. Customer Acquisition Cost (CAC)

What It Is: The total cost incurred to acquire a new customer.

Why It’s Important: CAC helps startups understand the efficiency of their marketing and sales efforts. Lowering CAC is crucial for improving profitability.

How to Calculate It:

5. Customer Lifetime Value (CLTV)

What It Is: The total revenue expected from a customer over their entire relationship with the business.

Why It’s Important: CLTV indicates the long-term value of customers and helps in making informed marketing and sales strategies.

How to Calculate It:

![]()

6. Monthly Recurring Revenue (MRR)

What It Is: The predictable revenue that a business expects to earn every month from its subscription-based services.

Why It’s Important: MRR provides insights into the business’s revenue stability and growth potential. It’s particularly important for SaaS (Software as a Service) startups.

How to Calculate It:

![]()

Time to Optimise Your Business

Are you a startup looking to optimise your financial performance? Partner with us for expert financial consulting. Our team can help you track, analyse, and improve your financial KPIs, ensuring your business is on the path to success.

Click here to book your free consultation now

Additional Financial KPIs to Consider

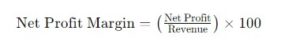

7. Net Profit Margin

What It Is: The percentage of revenue left after all expenses have been deducted.

Why It’s Important: Net profit margin shows the overall profitability of the business. It’s a key indicator of financial health and efficiency.

How to Calculate It:

8. Operating Cash Flow

What It Is: The cash generated from normal business operations.

Why It’s Important: Operating cash flow indicates the business’s ability to generate sufficient cash to maintain or expand operations.

How to Calculate It:

9. Quick Ratio

What It Is: A measure of a company’s ability to meet its short-term obligations with its most liquid assets.

Why It’s Important: The quick ratio is an indicator of short-term financial health. A ratio above 1 suggests that the company can cover its short-term liabilities without selling inventory.

How to Calculate It:

10. Return on Investment (ROI)

What It Is: The percentage of return generated on an investment relative to its cost.

Why It’s Important: ROI helps assess the profitability of investments. It’s a key metric for evaluating the success of marketing campaigns, product development, and other business activities.

How to Calculate It:

![]()

Why Monitoring Financial KPIs Matters

Monitoring financial KPIs provides startups with valuable insights into their operational efficiency, profitability, and financial stability. These metrics help businesses make data-driven decisions, identify growth opportunities, and mitigate risks.

Data-Driven Decisions

By regularly analysing KPIs, startups can make informed decisions based on real-time data. This approach helps in identifying trends, understanding market dynamics, and making strategic adjustments to business plans.

Attracting Investors

Investors rely heavily on financial KPIs to assess the viability and growth potential of a startup. Demonstrating strong financial performance through KPIs can attract potential investors and secure funding.

Identifying Growth Opportunities

KPIs help startups pinpoint areas of growth and improvement. By tracking metrics like revenue growth rate and customer acquisition cost, businesses can identify successful strategies and replicate them.

Mitigating Risks

Regularly monitoring KPIs allows startups to detect early warning signs of financial trouble. This proactive approach helps in addressing issues before they escalate, ensuring the long-term sustainability of the business.

Understanding the complex landscape of financial KPIs can be challenging for startups. Partnering with Adroit Consulting Group provides you with the expertise and support needed to optimise your financial performance. Our team of experts can help you track, analyse, and improve your financial KPIs, ensuring your business remains on the path to success.

Take the first step towards financial excellence today. Contact Adroit Consulting Group to learn how we can help you achieve your business goals.

Conclusion

Understanding and monitoring financial KPIs is essential for the success of any startup.

These metrics provide critical insights into the financial health of your business, helping you make informed decisions, attract investors, and identify growth opportunities.

By partnering with us, you can ensure that your startup’s financial performance is optimised, allowing you to focus on what you do best – growing your business.

Don’t risk taking on the complex world of financial KPIs alone.

Reach out to Adroit Consulting Group today and let us help you achieve financial excellence.